Funding strategy

The Group’s funding strategy in the debt capital markets is built around the following principles:

- Raise financing via a wholly owned Dutch financing subsidiary, Coca‑Cola HBC Finance B.V.

- Maintain a well-balanced debt redemption profile

- Improve funding costs of the Group

Funding sources

Our funding sources comprise of (i) Bonds issued through our Euro Medium Term Note (EMTN) Programme, (ii) Commercial paper issued through our Euro-Commercial Paper Programme (iii) a sustainability linked committed Revolving Credit Facility, (iv) bilateral facilities set up with relationship banks.

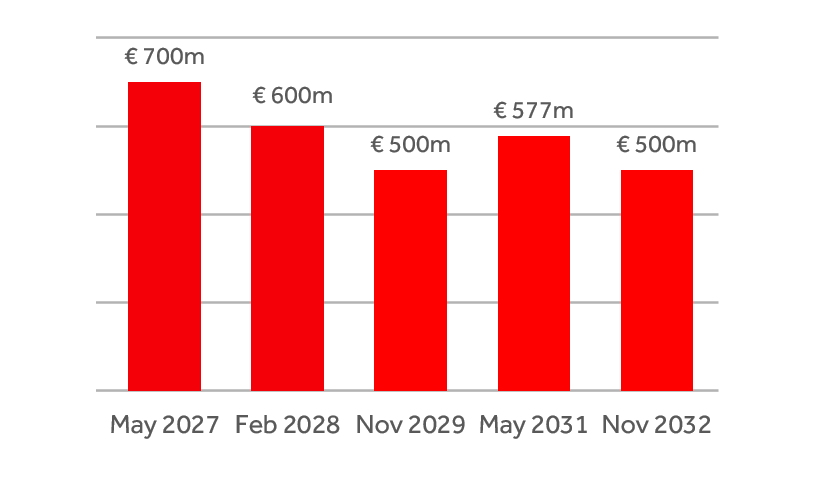

Debt maturity profile

This chart sets out the maturity profile of Coca-Cola HBC’s long-term debt as of 24 September 2025.