Focusing on the impact

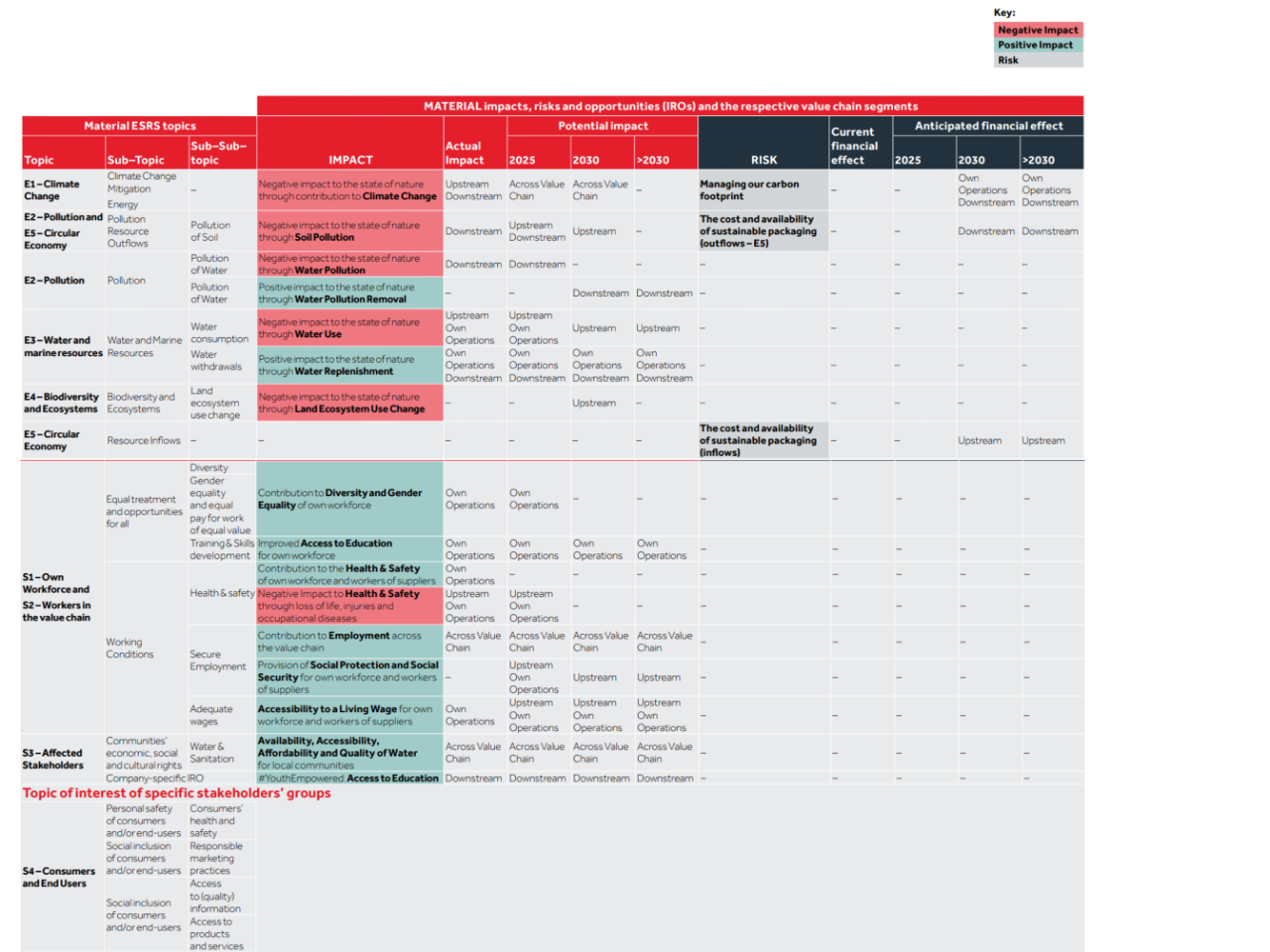

As ESRS topics include both impacts (i.e. pollution and climate change) and causes of impacts (i.e. waste and energy), our approach was to keep the impact analysis on the ‘impact’ level, and then to link the prioritised impacts to the respective ESRS topics/sub-topics for reporting purposes.

Environmental impacts

We leveraged the impact drivers of nature change under the Taskforce on Nature-related Financial Disclosures (TNFD), to identify a suitable impact level universe under a commonly established impact taxonomy.

We developed specific quantitative criteria, based on scientific tools and reports (such as the WWF Biodiversity Risk Filter, the WWF Water Risk Filter and the SBTN Unified Water Availability Dataset), relevant legislative frameworks, standards and guidelines, compliance management systems and various ISO audit reports.

People impacts

For a commonly established impact taxonomy for social and socio-economic impacts, we leveraged the United Nations Environment Programme (UNEP) Impact Radar.1 We use generic qualitative criteria, including assessment reports of impacts on people, information from legal reviews, compliance management systems, the GRI Content Index, the UN Global Compact Communication on Progress and various internal reports.

[1] Impacts to the environment under the UNEPFI were not used, as we used the TNFD categorisation of impact drivers instead.

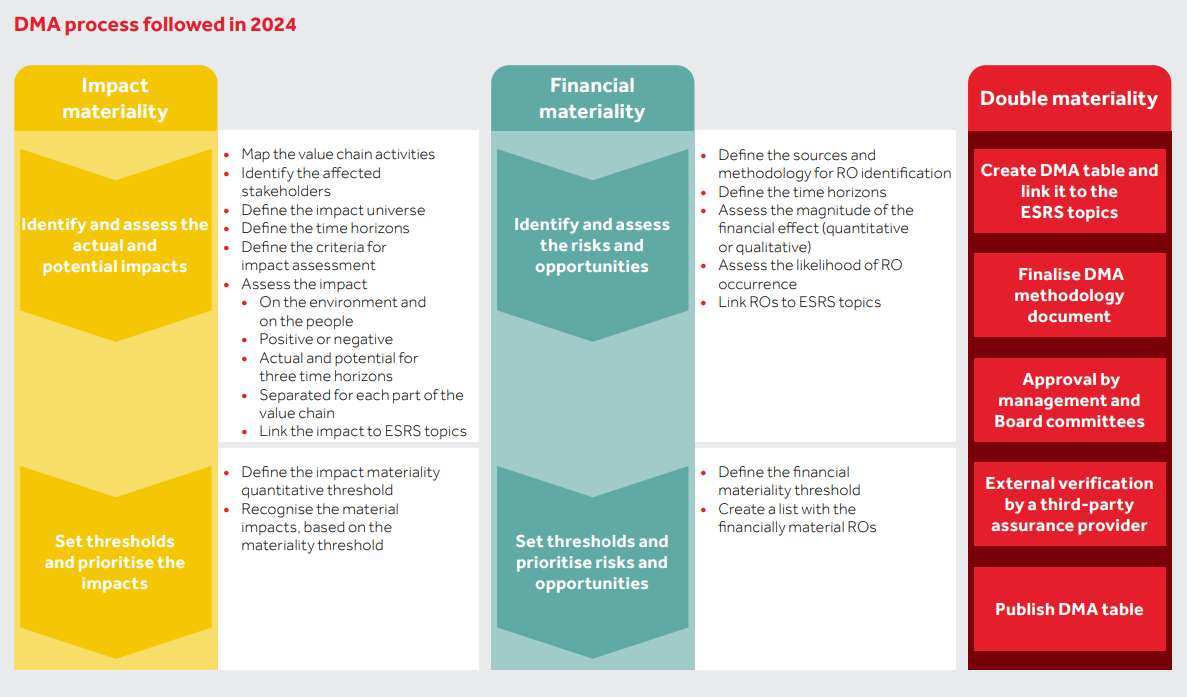

Methodology

We assessed the positive and negative impacts on nature and people, considering 2024 actual and potential impacts in three different time horizons (short – 2025, medium term – 2030 and long term – 2030+). Each part of our value chain (upstream, direct (own) operations and downstream) was also assessed separately. We assessed the severity (negative impact) and significance (positive impact) of each impact, and likelihood of occurrence of potential impact.

- Negative impact: scale (how grave the impact is), scope (how widespread the impact is) and irremediability (how easy the impact can be resolved).

- Positive impact: scale (how beneficial the impact is) and scope (how widespread the impact is). Quantitative thresholds range from 1 to 5, where 1 is low severity/significance/likelihood, while 5 is high severity/significance/likelihood.

After applying a specific formula, this creates a five-step scale for each impact: critical, major, moderate, minor and insignificant. The ‘major’ and ‘critical’ impacts are material.

Experts’ view and stakeholder involvement

In the initial assessment, we considered the internal experts’ views from different departments. We then engaged with external subject matter experts and impacted stakeholders in 26 dedicated interviews (including investors, shareholders, customers, suppliers, industry associations, NGOs and IGOs, community participants and international institutions), which were performed by an independent organisation.

This created a solid evidence base to inform the DMA, including: a) the perspective of affected stakeholders to understand the level of impact materiality and manage the total level of disclosure required; and b) better understanding the nature of the impacts, to guide any disclosure, in line with the needs of users of sustainability statements. The secondary objective was to understand the strategic implications to guide ongoing development and execution of our sustainability strategy, programmes and stakeholder engagement.

The output of the interviews confirmed that the topics of greatest interest to our external stakeholders are packaging (in-flow and out-flow), climate change mitigation, water and consumers’ health concerns.

Financial materiality

For the identification of ROs, linked to either principal or emerging risk categories, we leveraged our risk universe and our Business Resilience Framework. We also identified ROs arising from negative and positive impacts, as well as from dependencies across the value chain, using external tools such as Encore. We then mapped each RO to the relevant stage of our value chain – upstream, own operations or downstream – as well as to the time horizons set in the impact assessment, indicating when it is most likely to occur. As a last step of this process, we ensured a clear link between ROs and the corresponding ESRS topics and sub-topics.

To assess the ROs, we evaluated both the likelihood of their occurrence and the magnitude of their financial effect on CCHBC. The financial effect was determined either quantitatively or qualitatively, depending on data availability, considering effects on the financial position, financial performance, cash flows, cost of capital and access to finance. Where possible, we used the percentage of comparable EBIT as a quantitative metric to measure magnitude. Finally, we prioritised ROs based on their inherent risk level, derived from the combination of financial magnitude and likelihood. The inherent risk heatmap used follows a 1 to 5 scale, similar to the one used for impact materiality. Setting the threshold to above average, all ‘high’ and ‘critical’ ROs were deemed material.

Double materiality approval

Having assessed both impact materiality and financial materiality, we created our materiality table disclosing each material topic from either perspective (impact or financial) or both perspectives. Our DMA was then approved by CCHBC management (including the ELT-level members), endorsed by the Social Responsibility Committee and the Audit and Risk Committee of the Board of Directors. Our DMA was assured by a third-party organisation.

Stakeholder Forum – hearing from our stakeholders on what matters most

Stakeholder engagement is essential to grow our business and fulfil our purpose. Engaging and collaborating with various stakeholders facilitates better business decisions and alignment with commitments. Our key internal and external stakeholders include investors, employees, customers, consumers, suppliers, governments and regulators, The Coca-Cola Company and local communities. We also engage with other businesses through trade associations and universities.

Every year, we hold a Stakeholder Forum, to discuss our material topics with a group of experts. In 2024, our theme was ‘Harnessing the Circular Economy for Packaging – driving change through innovation and collaboration’, a topic of significant importance both to us and to many of our key stakeholders. During the event, we welcomed 160 participants, including customers, suppliers, NGO partners, academics, policymakers, investors and other interested parties, from more than 30 countries.

Discussions covered four key topics:

- Empowering consumers to adopt circular packaging solutions.

- The future of recycling and the role of innovation and technology.

- Reusable packaging systems and how to successfully scale these models.

- Creating value through strategic partnerships.

The Forum’s central message was the importance of aligning business growth with sustainability to ensure long-term resilience and success. Our stakeholders shared valuable insights and recommendations, including:

- Sustainability has evolved beyond an environmental imperative; it is now a social asset that shapes consumer identity and brand engagement.

- Progress depends on collaboration – partnering with our suppliers and stakeholders will accelerate innovation in sustainable packaging, from new materials to advanced recycling technologies.

- Sustainable choices must be made more attractive, accessible, and convenient for everyone.

- Achieving sustainability goals requires building networks, sharing ideas and collaborating on common solutions.

- Profit and purpose can, and must, co-exist effectively.

These insights have been reviewed by the Social Responsibility Committee and we will work to implement the Forum’s recommendations. We will also engage with our stakeholders, sharing the actions we are taking, throughout the year.